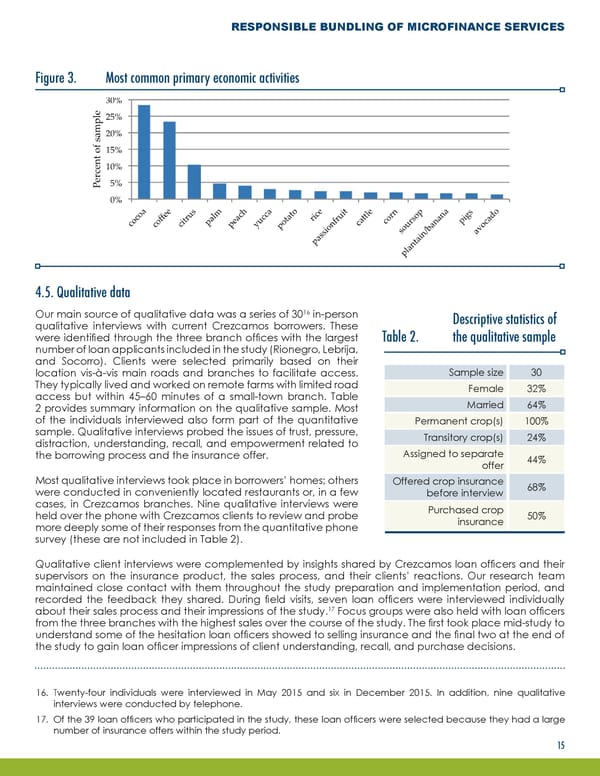

RESPONSIBLE BUNDLING OF MICROFINANCE SERVICES Figure 3. Most common primary economic activities 4.5. Qualitative data Our main source of qualitative data was a series of 3016 in-person Descriptive statistics of qualitative interviews with current Crezcamos borrowers. These were identified through the three branch offices with the largest Table 2. the qualitative sample number of loan applicants included in the study (Rionegro, Lebrija, and Socorro). Clients were selected primarily based on their location vis-à-vis main roads and branches to facilitate access. Sample size 30 They typically lived and worked on remote farms with limited road Female 32% access but within 45–60 minutes of a small-town branch. Table Married 64% 2 provides summary information on the qualitative sample. Most of the individuals interviewed also form part of the quantitative Permanent crop(s) 100% sample. Qualitative interviews probed the issues of trust, pressure, Transitory crop(s) 24% distraction, understanding, recall, and empowerment related to Assigned to separate the borrowing process and the insurance offer. offer 44% Most qualitative interviews took place in borrowers’ homes; others Offered crop insurance 68% were conducted in conveniently located restaurants or, in a few before interview cases, in Crezcamos branches. Nine qualitative interviews were Purchased crop held over the phone with Crezcamos clients to review and probe insurance 50% more deeply some of their responses from the quantitative phone survey (these are not included in Table 2). Qualitative client interviews were complemented by insights shared by Crezcamos loan officers and their supervisors on the insurance product, the sales process, and their clients’ reactions. Our research team maintained close contact with them throughout the study preparation and implementation period, and recorded the feedback they shared. During field visits, seven loan officers were interviewed individually of the study.17 Focus groups were also held with loan officers about their sales process and their impressions from the three branches with the highest sales over the course of the study. The first took place mid-study to understand some of the hesitation loan officers showed to selling insurance and the final two at the end of the study to gain loan officer impressions of client understanding, recall, and purchase decisions. 16. Twenty-four individuals were interviewed in May 2015 and six in December 2015. In addition, nine qualitative interviews were conducted by telephone. 17. Of the 39 loan officers who participated in the study, these loan officers were selected because they had a large number of insurance offers within the study period. 15

Responsible Bundling of Microfinance Services Page 17 Page 19

Responsible Bundling of Microfinance Services Page 17 Page 19