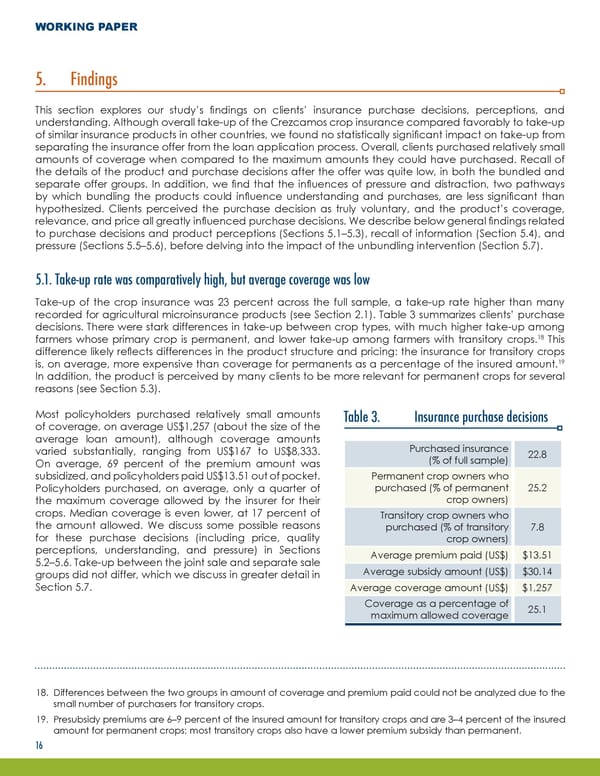

WORKING PAPER 5. Findings This section explores our study’s findings on clients’ insurance purchase decisions, perceptions, and understanding. Although overall take-up of the Crezcamos crop insurance compared favorably to take-up of similar insurance products in other countries, we found no statistically significant impact on take-up from separating the insurance offer from the loan application process. Overall, clients purchased relatively small amounts of coverage when compared to the maximum amounts they could have purchased. Recall of the details of the product and purchase decisions after the offer was quite low, in both the bundled and separate offer groups. In addition, we find that the influences of pressure and distraction, two pathways by which bundling the products could influence understanding and purchases, are less significant than hypothesized. Clients perceived the purchase decision as truly voluntary, and the product’s coverage, relevance, and price all greatly influenced purchase decisions. We describe below general findings related to purchase decisions and product perceptions (Sections 5.1–5.3), recall of information (Section 5.4), and pressure (Sections 5.5–5.6), before delving into the impact of the unbundling intervention (Section 5.7). 5.1. Take-up rate was comparatively high, but average coverage was low Take-up of the crop insurance was 23 percent across the full sample, a take-up rate higher than many recorded for agricultural microinsurance products (see Section 2.1). Table 3 summarizes clients’ purchase decisions. There were stark differences in take-up between crop types, with much higher take-up among farmers whose primary crop is permanent, and lower take-up among farmers with transitory crops.18 This difference likely reflects differences in the product structure and pricing: the insurance for transitory crops is, on average, more expensive than coverage for permanents as a percentage of the insured amount.19 In addition, the product is perceived by many clients to be more relevant for permanent crops for several reasons (see Section 5.3). Most policyholders purchased relatively small amounts Table 3. Insurance purchase decisions of coverage, on average US$1,257 (about the size of the average loan amount), although coverage amounts Purchased insurance varied substantially, ranging from US$167 to US$8,333. (% of full sample) 22.8 On average, 69 percent of the premium amount was subsidized, and policyholders paid US$13.51 out of pocket. Permanent crop owners who Policyholders purchased, on average, only a quarter of purchased (% of permanent 25.2 the maximum coverage allowed by the insurer for their crop owners) crops. Median coverage is even lower, at 17 percent of Transitory crop owners who the amount allowed. We discuss some possible reasons purchased (% of transitory 7.8 for these purchase decisions (including price, quality crop owners) perceptions, understanding, and pressure) in Sections Average premium paid (US$) $13.51 5.2–5.6. Take-up between the joint sale and separate sale Average subsidy amount (US$) $30.14 groups did not differ, which we discuss in greater detail in Section 5.7. Average coverage amount (US$) $1,257 Coverage as a percentage of 25.1 maximum allowed coverage 18. Differences between the two groups in amount of coverage and premium paid could not be analyzed due to the small number of purchasers for transitory crops. 19. Presubsidy premiums are 6–9 percent of the insured amount for transitory crops and are 3–4 percent of the insured amount for permanent crops; most transitory crops also have a lower premium subsidy than permanent. 16

Responsible Bundling of Microfinance Services Page 18 Page 20

Responsible Bundling of Microfinance Services Page 18 Page 20