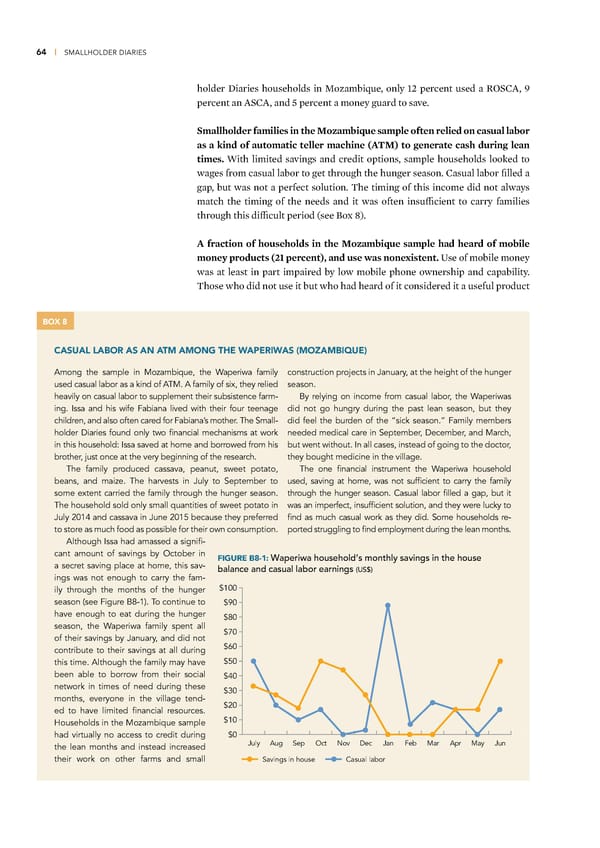

64 | SMALLHOLDER DIARIES holder ‰iaries households in –o—ambiue, only …‘ percent used a ª¦S†ˆ, ž percent an ˆS†ˆ, and ” percent a money guard to save Smallholder families in the oambi ue sample often relied on casual labor as a ƒind of automatic teller machine („) to generate cash during lean times ™ith limited savings and credit options, sample households looed to wages from casual labor to get through the hunger season †asual labor filled a gap, but was not a perfect solution Œhe timing of this income did not always match the timing of the needs and it was often insufficient to carry families through this difficult period (see £ox ¡) „ fraction of households in the oambi ue sample had heard of mobile money products (ŽŒ percent), and use was none‡istent ©se of mobile money was at least in part impaired by low mobile phone ownership and capability Œhose who did not use it but who had heard of it considered it a useful product BOX 8 CASUAL LABOR AS AN ATM AMONG THE WAPERIWAS (MOZAMBIQUE) Among the sample in Mozambique, the Waperiwa family construction projects in January, at the height of the hunger used casual labor as a kind of ATM. A family of six, they relied season. heavily on casual labor to supplement their subsistence farm- By relying on income from casual labor, the Waperiwas ing. Issa and his wife Fabiana lived with their four teenage did not go hungry during the past lean season, but they children, and also often cared for Fabiana’s mother. The Small- did feel the burden of the “sick season.” Family members holder Diaries found only two financial mechanisms at work needed medical care in September, December, and March, in this household: Issa saved at home and borrowed from his but went without. In all cases, instead of going to the doctor, brother, just once at the very beginning of the research. they bought medicine in the village. The family produced cassava, peanut, sweet potato, The one financial instrument the Waperiwa household beans, and maize. The harvests in July to September to used, saving at home, was not sufficient to carry the family some extent carried the family through the hunger season. through the hunger season. Casual labor filled a gap, but it The household sold only small quantities of sweet potato in was an imperfect, insufficient solution, and they were lucky to July 2014 and cassava in June 2015 because they preferred find as much casual work as they did. Some households re- to store as much food as possible for their own consumption. ported struggling to find employment during the lean months. Although Issa had amassed a signifi- cant amount of savings by October in FIGURE B8-1: Waperiwa household’s monthly savings in the house a secret saving place at home, this sav- balance and casual labor earnings (US$) ings was not enough to carry the fam- ily through the months of the hunger $100 season (see Figure B8-1). To continue to $90 have enough to eat during the hunger $80 season, the Waperiwa family spent all $70 of their savings by January, and did not contribute to their savings at all during $60 this time. Although the family may have $50 been able to borrow from their social $40 network in times of need during these $30 months, everyone in the village tend- $20 ed to have limited financial resources. Households in the Mozambique sample $10 had virtually no access to credit during $0 the lean months and instead increased July Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun their work on other farms and small Savings in house Casual labor

Financial Diaries with Smallholder Families Page 80 Page 82

Financial Diaries with Smallholder Families Page 80 Page 82