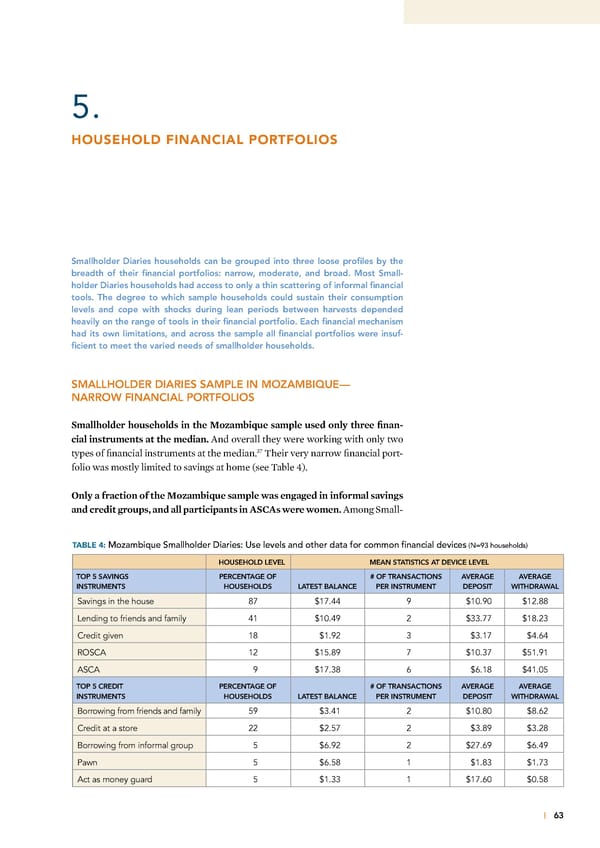

5. HOUSEHOLD FINANCIAL PORTFOLIOS Smallholder Diaries households can be grouped into three loose profiles by the breadth of their financial portfolios: narrow, moderate, and broad. Most Small- holder Diaries households had access to only a thin scattering of informal financial tools. The degree to which sample households could sustain their consumption levels and cope with shocks during lean periods between harvests depended heavily on the range of tools in their financial portfolio. Each financial mechanism had its own limitations, and across the sample all financial portfolios were insuf- ficient to meet the varied needs of smallholder households. SMALLHOLDER DIARIES SAMPLE IN MOZAMBIQUE— NARROW FINANCIAL PORTFOLIOS Smallholder households in the oambi ue sample used only three finan- cial instruments at the median ˆnd overall they were woring with only two Ÿ• types of financial instruments at the median Œheir very narrow financial port- folio was mostly limited to savings at home (see Œable “) –nly a fraction of the oambi ue sample was engaged in informal saings and credit groups, and all participants in „S”„s were women ˆmong Small- TABLE 4: Mozambique Smallholder Diaries: Use levels and other data for common financial devices (N=93 households) HOUSEHOLD LEVEL MEAN STATISTICS AT DEVICE LEVEL TOP 5 SAVINGS PERCENTAGE OF # OF TRANSACTIONS AVERAGE AVERAGE INSTRUMENTS HOUSEHOLDS LATEST BALANCE PER INSTRUMENT DEPOSIT WITHDRAWAL Savings in the house 87 $17.44 9 $10.90 $12.88 Lending to friends and family 41 $10.49 2 $33.77 $18.23 Credit given 18 $1.92 3 $3.17 $4.64 ROSCA 12 $15.89 7 $10.37 $51.91 ASCA 9 $17.38 6 $6.18 $41.05 TOP 5 CREDIT PERCENTAGE OF # OF TRANSACTIONS AVERAGE AVERAGE INSTRUMENTS HOUSEHOLDS LATEST BALANCE PER INSTRUMENT DEPOSIT WITHDRAWAL Borrowing from friends and family 59 $3.41 2 $10.80 $8.62 Credit at a store 22 $2.57 2 $3.89 $3.28 Borrowing from informal group 5 $6.92 2 $27.69 $6.49 Pawn 5 $6.58 1 $1.83 $1.73 Act as money guard 5 $1.33 1 $17.60 $0.58 | 63

Financial Diaries with Smallholder Families Page 79 Page 81

Financial Diaries with Smallholder Families Page 79 Page 81