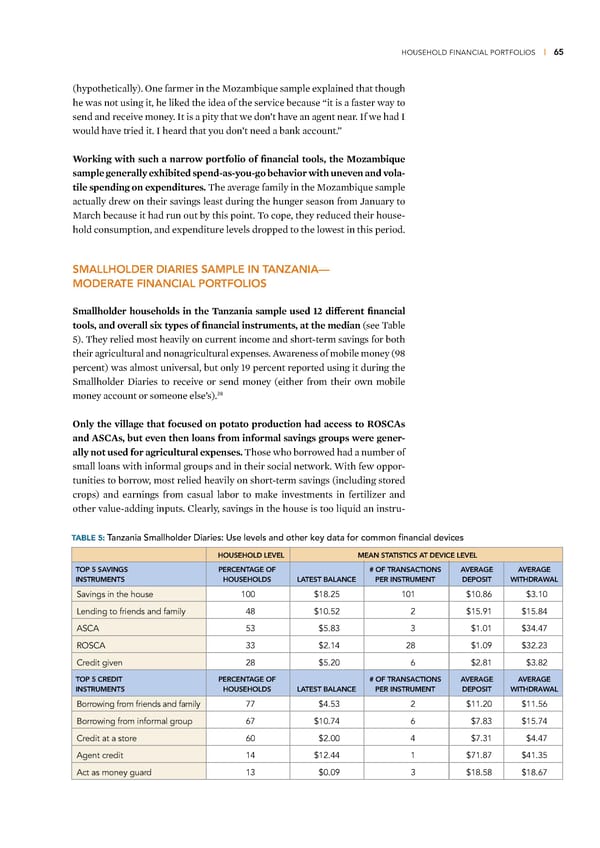

HOUSEHOLD FINANCIAL PORTFOLIOS | 65 (hypothetically) ¦ne farmer in the –o—ambiue sample explained that though he was not using it, he lied the idea of the service because “it is a faster way to send and receive money €t is a pity that we don’t have an agent near €f we had € would have tried it € heard that you don’t need a ban account” ‘orƒing with such a narrow portfolio of financial tools, the oambi ue sample generally e‡hibited spend-as-you-go behaior with uneen and ola- tile spending on e‡penditures Œhe average family in the –o—ambiue sample actually drew on their savings least during the hunger season from Žanuary to –arch because it had run out by this point Œo cope, they reduced their house- hold consumption, and expenditure levels dropped to the lowest in this period SMALLHOLDER DIARIES SAMPLE IN TANZANIA— MODERATE FINANCIAL PORTFOLIOS Smallholder households in the anania sample used ŒŽ different financial tools, and oerall si‡ types of financial instruments, at the median (see Œable ”) Œhey relied most heavily on current income and short-term savings for both their agricultural and nonagricultural expenses ˆwareness of mobile money (ž¡ percent) was almost universal, but only …ž percent reported using it during the Smallholder ‰iaries to receive or send money (either from their own mobile Ÿ¡ money account or someone else’s) –nly the illage that focused on potato production had access to —–S”„s and „S”„s, but een then loans from informal saings groups were gener- ally not used for agricultural e‡penses Œhose who borrowed had a number of small loans with informal groups and in their social networ ™ith few oppor- tunities to borrow, most relied heavily on short-term savings (including stored crops) and earnings from casual labor to mae investments in fertili—er and other value-adding inputs †learly, savings in the house is too liuid an instru- TABLE 5: Tanzania Smallholder Diaries: Use levels and other key data for common financial devices HOUSEHOLD LEVEL MEAN STATISTICS AT DEVICE LEVEL TOP 5 SAVINGS PERCENTAGE OF # OF TRANSACTIONS AVERAGE AVERAGE INSTRUMENTS HOUSEHOLDS LATEST BALANCE PER INSTRUMENT DEPOSIT WITHDRAWAL Savings in the house 100 $18.25 101 $10.86 $3.10 Lending to friends and family 48 $10.52 2 $15.91 $15.84 ASCA 53 $5.83 3 $1.01 $34.47 ROSCA 33 $2.14 28 $1.09 $32.23 Credit given 28 $5.20 6 $2.81 $3.82 TOP 5 CREDIT PERCENTAGE OF # OF TRANSACTIONS AVERAGE AVERAGE INSTRUMENTS HOUSEHOLDS LATEST BALANCE PER INSTRUMENT DEPOSIT WITHDRAWAL Borrowing from friends and family 77 $4.53 2 $11.20 $11.56 Borrowing from informal group 67 $10.74 6 $7.83 $15.74 Credit at a store 60 $2.00 4 $7.31 $4.47 Agent credit 14 $12.44 1 $71.87 $41.35 Act as money guard 13 $0.09 3 $18.58 $18.67

Financial Diaries with Smallholder Families Page 81 Page 83

Financial Diaries with Smallholder Families Page 81 Page 83