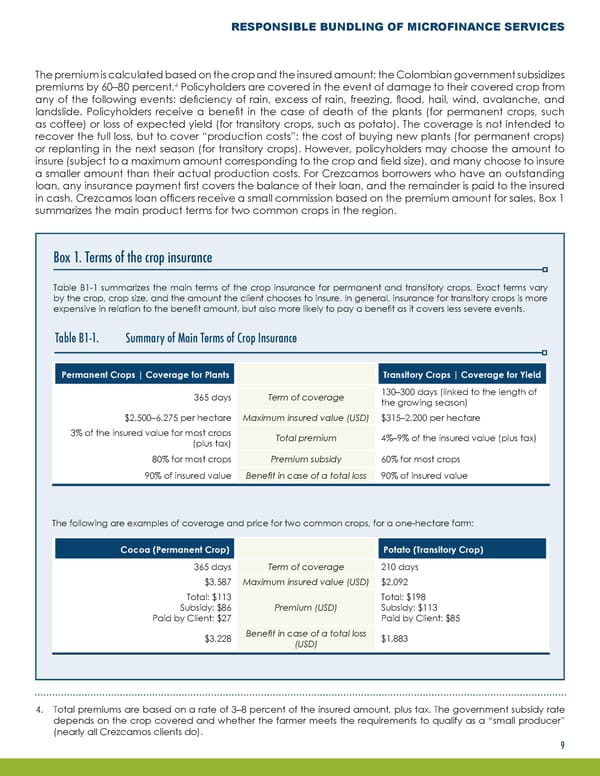

RESPONSIBLE BUNDLING OF MICROFINANCE SERVICES The premium is calculated based on the crop and the insured amount; the Colombian government subsidizes 4 premiums by 60–80 percent. Policyholders are covered in the event of damage to their covered crop from any of the following events: deficiency of rain, excess of rain, freezing, flood, hail, wind, avalanche, and landslide. Policyholders receive a benefit in the case of death of the plants (for permanent crops, such as coffee) or loss of expected yield (for transitory crops, such as potato). The coverage is not intended to recover the full loss, but to cover “production costs”: the cost of buying new plants (for permanent crops) or replanting in the next season (for transitory crops). However, policyholders may choose the amount to insure (subject to a maximum amount corresponding to the crop and field size), and many choose to insure a smaller amount than their actual production costs. For Crezcamos borrowers who have an outstanding loan, any insurance payment first covers the balance of their loan, and the remainder is paid to the insured in cash. Crezcamos loan officers receive a small commission based on the premium amount for sales. Box 1 summarizes the main product terms for two common crops in the region. Box 1. Terms of the crop insurance Table B1-1 summarizes the main terms of the crop insurance for permanent and transitory crops. Exact terms vary by the crop, crop size, and the amount the client chooses to insure. In general, insurance for transitory crops is more expensive in relation to the benefit amount, but also more likely to pay a benefit as it covers less severe events. Table B1-1. Summary of Main Terms of Crop Insurance Permanent Crops | Coverage for Plants Transitory Crops | Coverage for Yield 365 days Term of coverage 130–300 days (linked to the length of the growing season) $2,500–6,275 per hectare Maximum insured value (USD) $315–2,200 per hectare 3% of the insured value for most crops Total premium 4%–9% of the insured value (plus tax) (plus tax) 80% for most crops Premium subsidy 60% for most crops 90% of insured value Benefit in case of a total loss 90% of insured value The following are examples of coverage and price for two common crops, for a one-hectare farm: Cocoa (Permanent Crop) Potato (Transitory Crop) 365 days Term of coverage 210 days $3,587 Maximum insured value (USD) $2,092 Total: $113 Total: $198 Subsidy: $86 Premium (USD) Subsidy: $113 Paid by Client: $27 Paid by Client: $85 $3,228 Benefit in case of a total loss $1,883 (USD) 4. Total premiums are based on a rate of 3–8 percent of the insured amount, plus tax. The government subsidy rate depends on the crop covered and whether the farmer meets the requirements to qualify as a “small producer” (nearly all Crezcamos clients do). 9

Responsible Bundling of Microfinance Services Page 11 Page 13

Responsible Bundling of Microfinance Services Page 11 Page 13