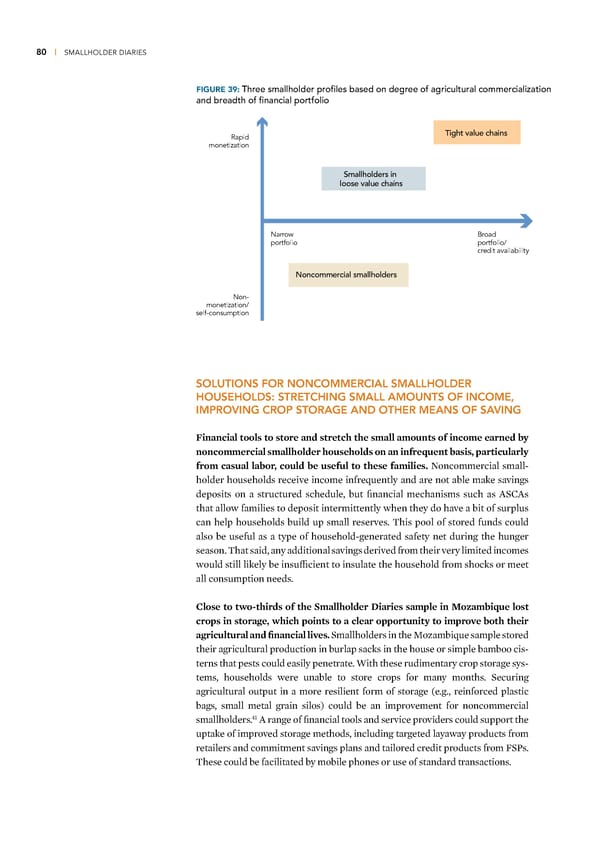

80 | SMALLHOLDER DIARIES FIGURE 39: Three smallholder profiles based on degree of agricultural commercialization and breadth of financial portfolio Rapid Tight value chains monetization Smallholders in loose value chains Narrow Broad portfolio portfolio/ credit availability Noncommercial smallholders Non- monetization/ self-consumption SOLUTIONS FOR NONCOMMERCIAL SMALLHOLDER HOUSEHOLDS: STRETCHING SMALL AMOUNTS OF INCOME, IMPROVING CROP STORAGE AND OTHER MEANS OF SAVING Financial tools to store and stretch the small amounts of income earned by noncommercial smallholder households on an infre uent basis, particularly from casual labor, could be useful to these families ˜oncommercial small- holder households receive income infreuently and are not able mae savings deposits on a structured schedule, but financial mechanisms such as ˆS†ˆs that allow families to deposit intermittently when they do have a bit of surplus can help households build up small reserves Œhis pool of stored funds could also be useful as a type of household-generated safety net during the hunger season Œhat said, any additional savings derived from their very limited incomes would still liely be insufficient to insulate the household from shocs or meet all consumption needs ”lose to two-thirds of the Smallholder Diaries sample in oambi ue lost crops in storage, which points to a clear opportunity to improe both their agricultural and financial lies Smallholders in the –o—ambiue sample stored their agricultural production in burlap sacs in the house or simple bamboo cis- terns that pests could easily penetrate ™ith these rudimentary crop storage sys- tems, households were unable to store crops for many months Securing agricultural output in a more resilient form of storage (eg, reinforced plastic bags, small metal grain silos) could be an improvement for noncommercial “… smallholders ˆ range of financial tools and service providers could support the uptae of improved storage methods, including targeted layaway products from retailers and commitment savings plans and tailored credit products from Ss Œhese could be facilitated by mobile phones or use of standard transactions

Financial Diaries with Smallholder Families Page 98 Page 100

Financial Diaries with Smallholder Families Page 98 Page 100