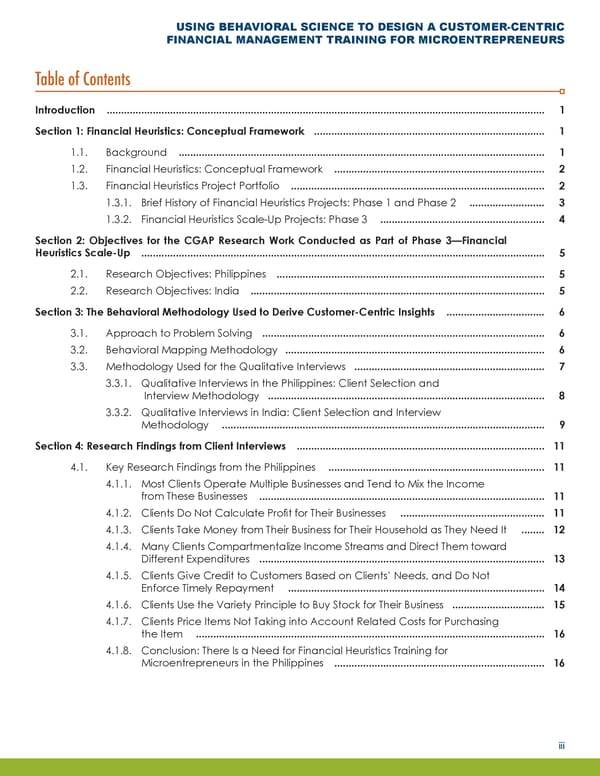

USING BEHAVIORAL SCIENCE TO DESIGN A CUSTOMER-CENTRIC FINANCIAL MANAGEMENT TRAINING FOR MICROENTREPRENEURS Table of Contents Introduction ........................................................................................................................................................ 1 Section 1: Financial Heuristics: Conceptual Framework ................................................................................ 1 1.1. Background ............................................................................................................................... 1 1.2. Financial Heuristics: Conceptual Framework ......................................................................... 2 1.3. Financial Heuristics Project Portfolio ........................................................................................ 2 1.3.1. Brief History of Financial Heuristics Projects: Phase 1 and Phase 2 .......................... 3 1.3.2. Financial Heuristics Scale-Up Projects: Phase 3 ......................................................... 4 Section 2: Objectives for the CGAP Research Work Conducted as Part of Phase 3—Financial Heuristics Scale-Up ............................................................................................................................................ 5 2.1. Research Objectives: Philippines ............................................................................................. 5 2.2. Research Objectives: India ...................................................................................................... 5 Section 3: The Behavioral Methodology Used to Derive Customer-Centric Insights .................................. 6 3.1. Approach to Problem Solving .................................................................................................. 6 3.2. Behavioral Mapping Methodology .......................................................................................... 6 3.3. Methodology Used for the Qualitative Interviews .................................................................. 7 3.3.1. Qualitative Interviews in the Philippines: Client Selection and Interview Methodology ................................................................................................ 8 3.3.2. Qualitative Interviews in India: Client Selection and Interview Methodology ................................................................................................................ 9 Section 4: Research Findings from Client Interviews ...................................................................................... 11 4.1. Key Research Findings from the Philippines ........................................................................... 11 4.1.1. Most Clients Operate Multiple Businesses and Tend to Mix the Income from These Businesses ................................................................................................... 11 4.1.2. Clients Do Not Calculate Profit for Their Businesses .................................................. 11 4.1.3. Clients Take Money from Their Business for Their Household as They Need It ........ 12 4.1.4. Many Clients Compartmentalize Income Streams and Direct Them toward Different Expenditures ................................................................................................... 13 4.1.5. Clients Give Credit to Customers Based on Clients’ Needs, and Do Not Enforce Timely Repayment ......................................................................................... 14 4.1.6. Clients Use the Variety Principle to Buy Stock for Their Business ................................ 15 4.1.7. Clients Price Items Not Taking into Account Related Costs for Purchasing the Item ......................................................................................................................... 16 4.1.8. Conclusion: There Is a Need for Financial Heuristics Training for Microentrepreneurs in the Philippines ......................................................................... 16 iii

Using Behavioral Science to Design a Customer-Centric Financial Management Training for Microentrepreneurs Page 1 Page 3

Using Behavioral Science to Design a Customer-Centric Financial Management Training for Microentrepreneurs Page 1 Page 3