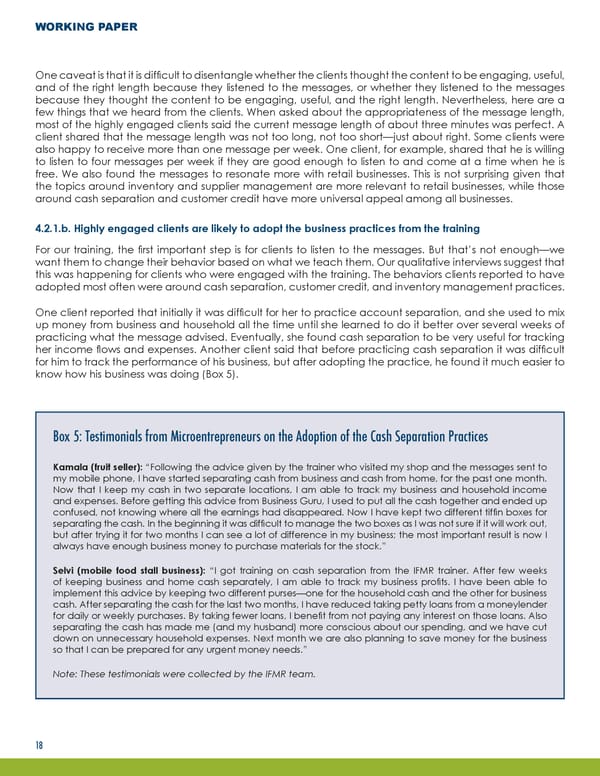

WORKING PAPER One caveat is that it is difficult to disentangle whether the clients thought the content to be engaging, useful, and of the right length because they listened to the messages, or whether they listened to the messages because they thought the content to be engaging, useful, and the right length. Nevertheless, here are a few things that we heard from the clients. When asked about the appropriateness of the message length, most of the highly engaged clients said the current message length of about three minutes was perfect. A client shared that the message length was not too long, not too short—just about right. Some clients were also happy to receive more than one message per week. One client, for example, shared that he is willing to listen to four messages per week if they are good enough to listen to and come at a time when he is free. We also found the messages to resonate more with retail businesses. This is not surprising given that the topics around inventory and supplier management are more relevant to retail businesses, while those around cash separation and customer credit have more universal appeal among all businesses. 4.2.1.b. Highly engaged clients are likely to adopt the business practices from the training For our training, the first important step is for clients to listen to the messages. But that’s not enough—we want them to change their behavior based on what we teach them. Our qualitative interviews suggest that this was happening for clients who were engaged with the training. The behaviors clients reported to have adopted most often were around cash separation, customer credit, and inventory management practices. One client reported that initially it was difficult for her to practice account separation, and she used to mix up money from business and household all the time until she learned to do it better over several weeks of practicing what the message advised. Eventually, she found cash separation to be very useful for tracking her income flows and expenses. Another client said that before practicing cash separation it was difficult for him to track the performance of his business, but after adopting the practice, he found it much easier to know how his business was doing (Box 5). Box 5: Testimonials from Microentrepreneurs on the Adoption of the Cash Separation Practices Kamala (fruit seller): “Following the advice given by the trainer who visited my shop and the messages sent to my mobile phone, I have started separating cash from business and cash from home, for the past one month. Now that I keep my cash in two separate locations, I am able to track my business and household income and expenses. Before getting this advice from Business Guru, I used to put all the cash together and ended up confused, not knowing where all the earnings had disappeared. Now I have kept two different tiffin boxes for separating the cash. In the beginning it was difficult to manage the two boxes as I was not sure if it will work out, but after trying it for two months I can see a lot of difference in my business; the most important result is now I always have enough business money to purchase materials for the stock.” Selvi (mobile food stall business): “I got training on cash separation from the IFMR trainer. After few weeks of keeping business and home cash separately, I am able to track my business profits. I have been able to implement this advice by keeping two different purses—one for the household cash and the other for business cash. After separating the cash for the last two months, I have reduced taking petty loans from a moneylender for daily or weekly purchases. By taking fewer loans, I benefit from not paying any interest on those loans. Also separating the cash has made me (and my husband) more conscious about our spending, and we have cut down on unnecessary household expenses. Next month we are also planning to save money for the business so that I can be prepared for any urgent money needs.” Note: These testimonials were collected by the IFMR team. 18

Using Behavioral Science to Design a Customer-Centric Financial Management Training for Microentrepreneurs Page 20 Page 22

Using Behavioral Science to Design a Customer-Centric Financial Management Training for Microentrepreneurs Page 20 Page 22