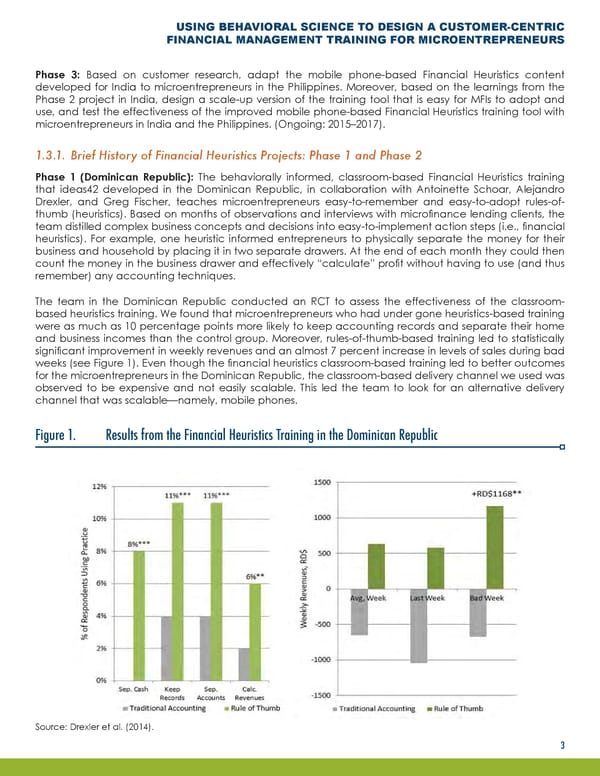

USING BEHAVIORAL SCIENCE TO DESIGN A CUSTOMER-CENTRIC FINANCIAL MANAGEMENT TRAINING FOR MICROENTREPRENEURS Phase 3: Based on customer research, adapt the mobile phone-based Financial Heuristics content developed for India to microentrepreneurs in the Philippines. Moreover, based on the learnings from the Phase 2 project in India, design a scale-up version of the training tool that is easy for MFIs to adopt and use, and test the effectiveness of the improved mobile phone-based Financial Heuristics training tool with microentrepreneurs in India and the Philippines. (Ongoing: 2015–2017). 1.3.1. Brief History of Financial Heuristics Projects: Phase 1 and Phase 2 Phase 1 (Dominican Republic): The behaviorally informed, classroom-based Financial Heuristics training that ideas42 developed in the Dominican Republic, in collaboration with Antoinette Schoar, Alejandro Drexler, and Greg Fischer, teaches microentrepreneurs easy-to-remember and easy-to-adopt rules-of- thumb (heuristics). Based on months of observations and interviews with microfinance lending clients, the team distilled complex business concepts and decisions into easy-to-implement action steps (i.e., financial heuristics). For example, one heuristic informed entrepreneurs to physically separate the money for their business and household by placing it in two separate drawers. At the end of each month they could then count the money in the business drawer and effectively “calculate” profit without having to use (and thus remember) any accounting techniques. The team in the Dominican Republic conducted an RCT to assess the effectiveness of the classroom- based heuristics training. We found that microentrepreneurs who had under gone heuristics-based training were as much as 10 percentage points more likely to keep accounting records and separate their home and business incomes than the control group. Moreover, rules-of-thumb-based training led to statistically significant improvement in weekly revenues and an almost 7 percent increase in levels of sales during bad weeks (see Figure 1). Even though the financial heuristics classroom-based training led to better outcomes for the microentrepreneurs in the Dominican Republic, the classroom-based delivery channel we used was observed to be expensive and not easily scalable. This led the team to look for an alternative delivery channel that was scalable—namely, mobile phones. Figure 1. Results from the Financial Heuristics Training in the Dominican Republic Source: Drexler et al. (2014). 3

Using Behavioral Science to Design a Customer-Centric Financial Management Training for Microentrepreneurs Page 5 Page 7

Using Behavioral Science to Design a Customer-Centric Financial Management Training for Microentrepreneurs Page 5 Page 7