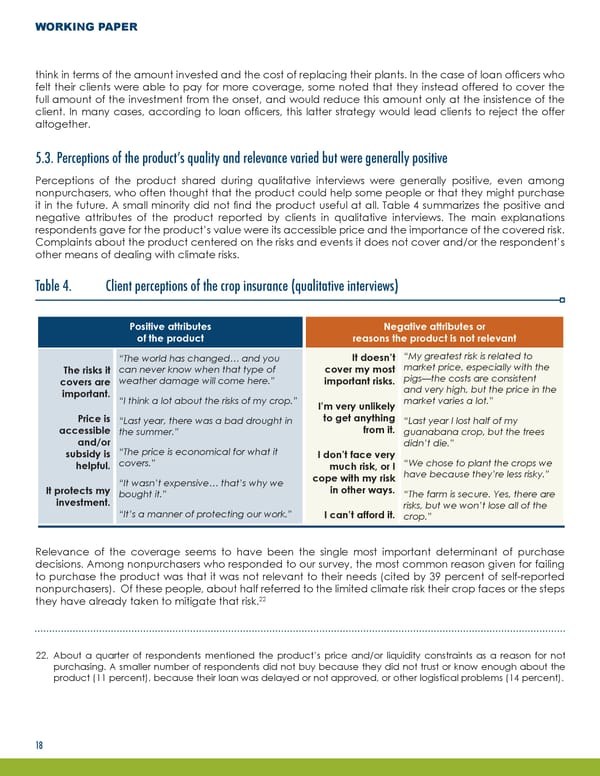

WORKING PAPER think in terms of the amount invested and the cost of replacing their plants. In the case of loan officers who felt their clients were able to pay for more coverage, some noted that they instead offered to cover the full amount of the investment from the onset, and would reduce this amount only at the insistence of the client. In many cases, according to loan officers, this latter strategy would lead clients to reject the offer altogether. 5.3. Perceptions of the product’s quality and relevance varied but were generally positive Perceptions of the product shared during qualitative interviews were generally positive, even among nonpurchasers, who often thought that the product could help some people or that they might purchase it in the future. A small minority did not find the product useful at all. Table 4 summarizes the positive and negative attributes of the product reported by clients in qualitative interviews. The main explanations respondents gave for the product’s value were its accessible price and the importance of the covered risk. Complaints about the product centered on the risks and events it does not cover and/or the respondent’s other means of dealing with climate risks. Table 4. Client perceptions of the crop insurance (qualitative interviews) Positive attributes Negative attributes or of the product reasons the product is not relevant “The world has changed… and you It doesn’t “My greatest risk is related to The risks it can never know when that type of cover my most market price, especially with the covers are weather damage will come here.” important risks. pigs—the costs are consistent important. and very high, but the price in the “I think a lot about the risks of my crop.” I’m very unlikely market varies a lot.” Price is “Last year, there was a bad drought in to get anything “Last year I lost half of my accessible the summer.” from it. guanabana crop, but the trees and/or didn’t die.” subsidy is “The price is economical for what it I don’t face very helpful. covers.” much risk, or I “We chose to plant the crops we “It wasn’t expensive… that’s why we cope with my risk have because they’re less risky.” It protects my bought it.” in other ways. “The farm is secure. Yes, there are investment. risks, but we won’t lose all of the “It’s a manner of protecting our work.” I can’t afford it. crop.” Relevance of the coverage seems to have been the single most important determinant of purchase decisions. Among nonpurchasers who responded to our survey, the most common reason given for failing to purchase the product was that it was not relevant to their needs (cited by 39 percent of self-reported nonpurchasers). Of these people, about half referred to the limited climate risk their crop faces or the steps 22 they have already taken to mitigate that risk. 22. About a quarter of respondents mentioned the product’s price and/or liquidity constraints as a reason for not purchasing. A smaller number of respondents did not buy because they did not trust or know enough about the product (11 percent), because their loan was delayed or not approved, or other logistical problems (14 percent). 18

Responsible Bundling of Microfinance Services Page 20 Page 22

Responsible Bundling of Microfinance Services Page 20 Page 22