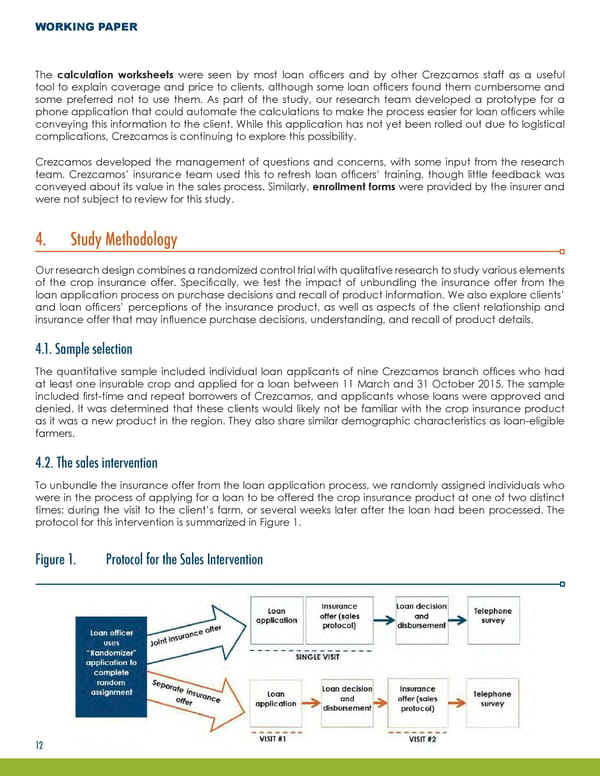

WORKING PAPER The calculation worksheets were seen by most loan officers and by other Crezcamos staff as a useful tool to explain coverage and price to clients, although some loan officers found them cumbersome and some preferred not to use them. As part of the study, our research team developed a prototype for a phone application that could automate the calculations to make the process easier for loan officers while conveying this information to the client. While this application has not yet been rolled out due to logistical complications, Crezcamos is continuing to explore this possibility. Crezcamos developed the management of questions and concerns, with some input from the research team. Crezcamos’ insurance team used this to refresh loan officers’ training, though little feedback was conveyed about its value in the sales process. Similarly, enrollment forms were provided by the insurer and were not subject to review for this study. 4. Study Methodology Our research design combines a randomized control trial with qualitative research to study various elements of the crop insurance offer. Specifically, we test the impact of unbundling the insurance offer from the loan application process on purchase decisions and recall of product information. We also explore clients’ and loan officers’ perceptions of the insurance product, as well as aspects of the client relationship and insurance offer that may influence purchase decisions, understanding, and recall of product details. 4.1. Sample selection The quantitative sample included individual loan applicants of nine Crezcamos branch offices who had at least one insurable crop and applied for a loan between 11 March and 31 October 2015. The sample included first-time and repeat borrowers of Crezcamos, and applicants whose loans were approved and denied. It was determined that these clients would likely not be familiar with the crop insurance product as it was a new product in the region. They also share similar demographic characteristics as loan-eligible farmers. 4.2. The sales intervention To unbundle the insurance offer from the loan application process, we randomly assigned individuals who were in the process of applying for a loan to be offered the crop insurance product at one of two distinct times: during the visit to the client’s farm, or several weeks later after the loan had been processed. The protocol for this intervention is summarized in Figure 1. Figure 1. Protocol for the Sales Intervention 12

Responsible Bundling of Microfinance Services Page 14 Page 16

Responsible Bundling of Microfinance Services Page 14 Page 16