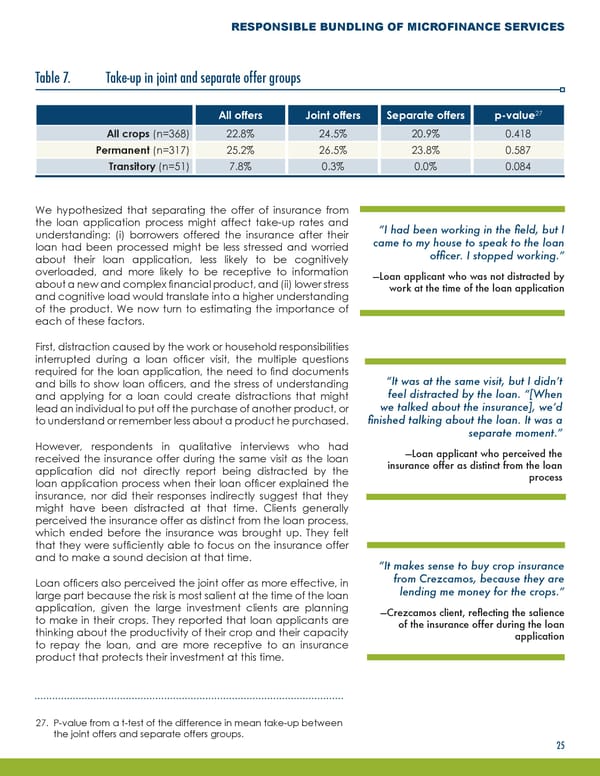

RESPONSIBLE BUNDLING OF MICROFINANCE SERVICES Table 7. Take-up in joint and separate offer groups 27 All offers Joint offers Separate offers p-value All crops (n=368) 22.8% 24.5% 20.9% 0.418 Permanent (n=317) 25.2% 26.5% 23.8% 0.587 Transitory (n=51) 7.8% 0.3% 0.0% 0.084 We hypothesized that separating the offer of insurance from the loan application process might affect take-up rates and “I had been working in the field, but I understanding: (i) borrowers offered the insurance after their came to my house to speak to the loan loan had been processed might be less stressed and worried officer. I stopped working.” about their loan application, less likely to be cognitively overloaded, and more likely to be receptive to information —Loan applicant who was not distracted by about a new and complex financial product, and (ii) lower stress work at the time of the loan application and cognitive load would translate into a higher understanding of the product. We now turn to estimating the importance of each of these factors. First, distraction caused by the work or household responsibilities interrupted during a loan officer visit, the multiple questions required for the loan application, the need to find documents “It was at the same visit, but I didn’t and bills to show loan officers, and the stress of understanding feel distracted by the loan. “[When and applying for a loan could create distractions that might we talked about the insurance], we’d lead an individual to put off the purchase of another product, or to understand or remember less about a product he purchased. finished talking about the loan. It was a separate moment.” However, respondents in qualitative interviews who had —Loan applicant who perceived the received the insurance offer during the same visit as the loan insurance offer as distinct from the loan application did not directly report being distracted by the process loan application process when their loan officer explained the insurance, nor did their responses indirectly suggest that they might have been distracted at that time. Clients generally perceived the insurance offer as distinct from the loan process, brought up. which ended before the insurance was They felt that they were sufficiently able to focus on the insurance offer and to make a sound decision at that time. “It makes sense to buy crop insurance Loan officers also perceived the joint offer as more effective, in from Crezcamos, because they are large part because the risk is most salient at the time of the loan lending me money for the crops.” application, given the large investment clients are planning —Crezcamos client, reflecting the salience to make in their crops. They reported that loan applicants are of the insurance offer during the loan thinking about the productivity of their crop and their capacity application to repay the loan, and are more receptive to an insurance product that protects their investment at this time. 27. P-value from a t-test of the difference in mean take-up between the joint offers and separate offers groups. 25

Responsible Bundling of Microfinance Services Page 27 Page 29

Responsible Bundling of Microfinance Services Page 27 Page 29