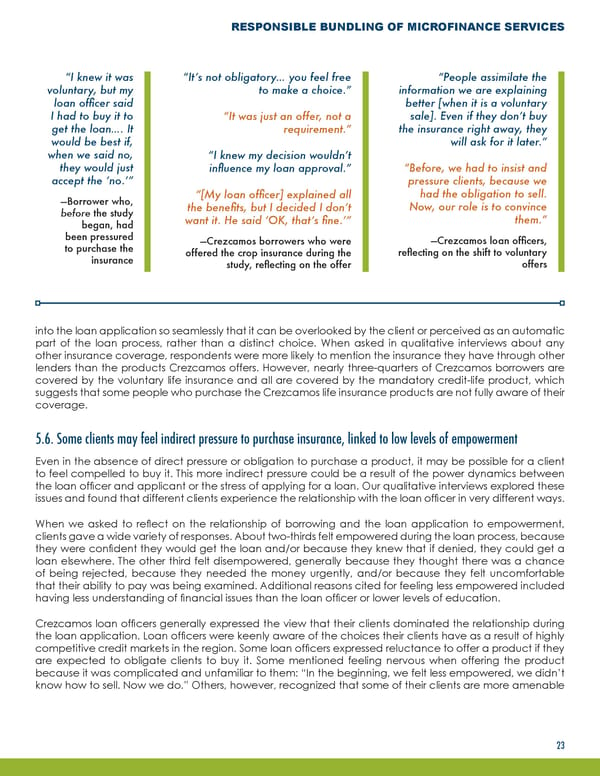

RESPONSIBLE BUNDLING OF MICROFINANCE SERVICES “I knew it was “It’s not obligatory… you feel free “People assimilate the voluntary, but my to make a choice.” information we are explaining loan officer said better [when it is a voluntary I had to buy it to “It was just an offer, not a sale]. Even if they don’t buy get the loan…. It requirement.” the insurance right away, they would be best if, will ask for it later.” when we said no, “I knew my decision wouldn’t they would just influence my loan approval.” “Before, we had to insist and accept the ‘no.’” pressure clients, because we —Borrower who, “[My loan officer] explained all had the obligation to sell. before the study the benefits, but I decided I don’t Now, our role is to convince began, had want it. He said ‘OK, that’s fine.’” them.” been pressured —Crezcamos borrowers who were —Crezcamos loan officers, to purchase the offered the crop insurance during the reflecting on the shift to voluntary insurance study, reflecting on the offer offers into the loan application so seamlessly that it can be overlooked by the client or perceived as an automatic part of the loan process, rather than a distinct choice. When asked in qualitative interviews about any other insurance coverage, respondents were more likely to mention the insurance they have through other lenders than the products Crezcamos offers. However, nearly three-quarters of Crezcamos borrowers are covered by the voluntary life insurance and all are covered by the mandatory credit-life product, which suggests that some people who purchase the Crezcamos life insurance products are not fully aware of their coverage. 5.6. Some clients may feel indirect pressure to purchase insurance, linked to low levels of empowerment Even in the absence of direct pressure or obligation to purchase a product, it may be possible for a client to feel compelled to buy it. This more indirect pressure could be a result of the power dynamics between the loan officer and applicant or the stress of applying for a loan. Our qualitative interviews explored these issues and found that different clients experience the relationship with the loan officer in very different ways. When we asked to reflect on the relationship of borrowing and the loan application to empowerment, loan process, because clients gave a wide variety of responses. About two-thirds felt empowered during the they were confident they would get the loan and/or because they knew that if denied, they could get a loan elsewhere. The other third felt disempowered, generally because they thought there was a chance of being rejected, because they needed the money urgently, and/or because they felt uncomfortable that their ability to pay was being examined. Additional reasons cited for feeling less empowered included having less understanding of financial issues than the loan officer or lower levels of education. Crezcamos loan officers generally expressed the view that their clients dominated the relationship during the loan application. Loan officers were keenly aware of the choices their clients have as a result of highly competitive credit markets in the region. Some loan officers expressed reluctance to offer a product if they are expected to obligate clients to buy it. Some mentioned feeling nervous when offering the product because it was complicated and unfamiliar to them: “In the beginning, we felt less empowered, we didn’t know how to sell. Now we do.” Others, however, recognized that some of their clients are more amenable 23

Responsible Bundling of Microfinance Services Page 25 Page 27

Responsible Bundling of Microfinance Services Page 25 Page 27