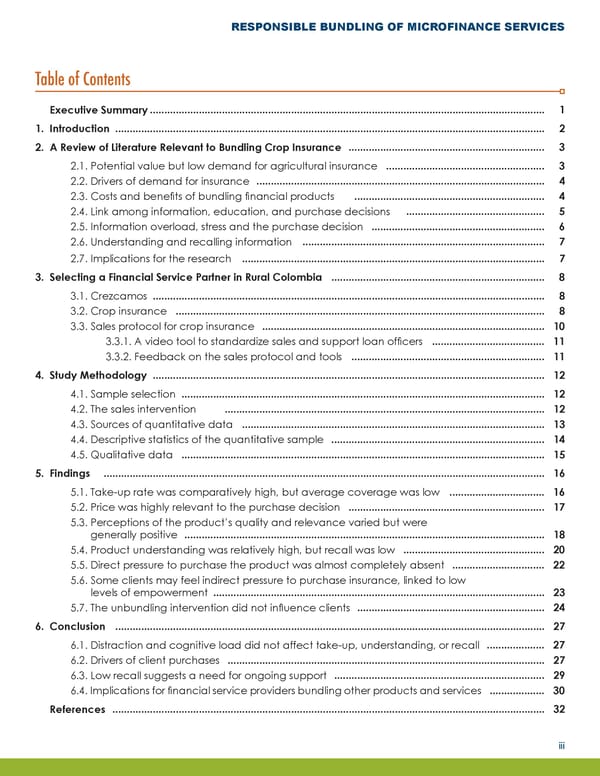

RESPONSIBLE BUNDLING OF MICROFINANCE SERVICES Table of Contents Executive Summary......................................................................................................................................... 1 1. Introduction ..................................................................................................................................................... 2 2. A Review of Literature Relevant to Bundling Crop Insurance .................................................................... 3 2.1. Potential value but low demand for agricultural insurance ....................................................... 3 2.2. Drivers of demand for insurance .................................................................................................... 4 2.3. Costs and benefits of bundling financial products .................................................................. 4 2.4. Link among information, education, and purchase decisions ................................................ 5 2.5. Information overload, stress and the purchase decision ............................................................ 6 2.6. Understanding and recalling information .................................................................................... 7 2.7. Implications for the research ......................................................................................................... 7 3. Selecting a Financial Service Partner in Rural Colombia .......................................................................... 8 3.1. Crezcamos ........................................................................................................................................ 8 3.2. Crop insurance ................................................................................................................................ 8 3.3. Sales protocol for crop insurance .................................................................................................. 10 3.3.1. A video tool to standardize sales and support loan officers ....................................... 11 3.3.2. Feedback on the sales protocol and tools ................................................................... 11 4. Study Methodology ........................................................................................................................................ 12 4.1. Sample selection .............................................................................................................................. 12 4.2. The sales intervention ............................................................................................................... 12 4.3. Sources of quantitative data ......................................................................................................... 13 4.4. Descriptive statistics of the quantitative sample .......................................................................... 14 4.5. Qualitative data .............................................................................................................................. 15 5. Findings ......................................................................................................................................................... 16 5.1. Take-up rate was comparatively high, but average coverage was low ................................. 16 5.2. Price was highly relevant to the purchase decision .................................................................... 17 5.3. Perceptions of the product’s quality and relevance varied but were generally positive ............................................................................................................................. 18 5.4. Product understanding was relatively high, but recall was low ................................................. 20 5.5. Direct pressure to purchase the product was almost completely absent ................................ 22 5.6. Some clients may feel indirect pressure to purchase insurance, linked to low levels of empowerment ................................................................................................................... 23 5.7. The unbundling intervention did not influence clients ................................................................. 24 6. Conclusion ..................................................................................................................................................... 27 6.1. Distraction and cognitive load did not affect take-up, understanding, or recall .................... 27 6.2. Drivers of client purchases .............................................................................................................. 27 6.3. Low recall suggests a need for ongoing support ......................................................................... 29 6.4. Implications for financial service providers bundling other products and services ................... 30 References ...................................................................................................................................................... 32 iii

Responsible Bundling of Microfinance Services Page 1 Page 3

Responsible Bundling of Microfinance Services Page 1 Page 3