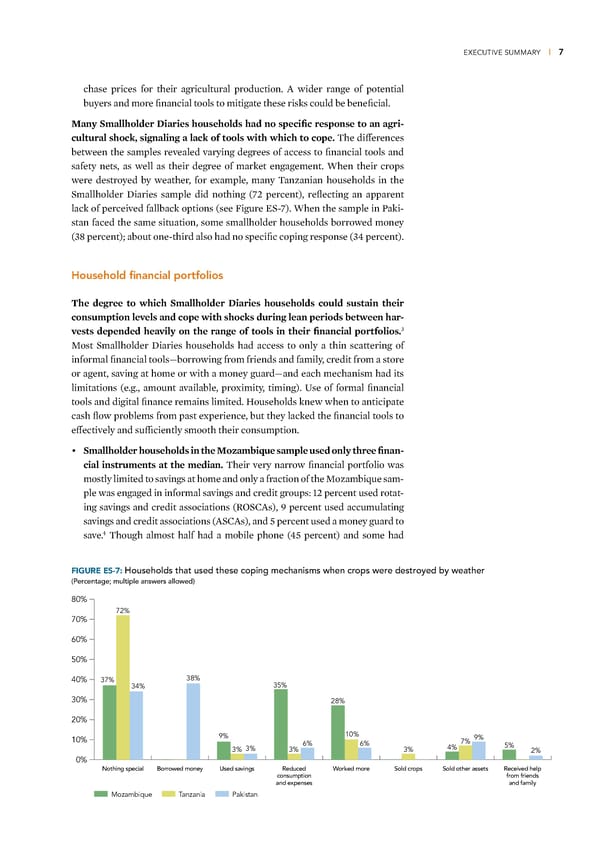

EXECUTIVE SUMMARY | 7 chase prices for their agricultural production ˆ wider range of potential buyers and more financial tools to mitigate these riss could be beneficial any Smallholder Diaries households had no specific response to an agri- cultural shocƒ, signaling a lacƒ of tools with which to cope Œhe differences between the samples revealed varying degrees of access to financial tools and safety nets, as well as their degree of maret engagement ™hen their crops were destroyed by weather, for example, many Œan—anian households in the Smallholder ‰iaries sample did nothing (•‘ percent), reflecting an apparent lac of perceived fallbac options (see igure œS-•) ™hen the sample in ai- stan faced the same situation, some smallholder households borrowed money (Ÿ¡ percent) about one-third also had no specific coping response (Ÿ“ percent) Household financial portfolios he degree to which Smallholder Diaries households could sustain their consumption leels and cope with shocƒs during lean periods between har- Ÿ ests depended heaily on the range of tools in their financial portfolios –ost Smallholder ‰iaries households had access to only a thin scattering of informal financial tools—borrowing from friends and family, credit from a store or agent, saving at home or with a money guard—and each mechanism had its limitations (eg, amount available, proximity, timing) ©se of formal financial tools and digital finance remains limited Households new when to anticipate cash flow problems from past experience, but they laced the financial tools to effectively and sufficiently smooth their consumption • Smallholder households in the oambi ue sample used only three finan- cial instruments at the median Œheir very narrow financial portfolio was mostly limited to savings at home and only a fraction of the –o—ambiue sam- ple was engaged in informal savings and credit groups …‘ percent used rotat- ing savings and credit associations (ª¦S†ˆs), ž percent used accumulating savings and credit associations (ˆS†ˆs), and ” percent used a money guard to “ save Œhough almost half had a mobile phone (“” percent) and some had FIGURE ES-7: Households that used these coping mechanisms when crops were destroyed by weather (Percentage; multiple answers allowed) 80% 72% 70% 60% 50% 40% 37% 38% 34% 35% 30% 28% 20% 10% 9% 10% 9% 6% 6% 4% 7% 5% 3% 3% 3% 3% 2% 0% Nothing specialBorrowed money Used savings Reduced Worked more Sold crops Sold other assets Received help consumption from friends and expenses and family Mozambique Tanzania Pakistan

Financial Diaries with Smallholder Families Page 16 Page 18

Financial Diaries with Smallholder Families Page 16 Page 18