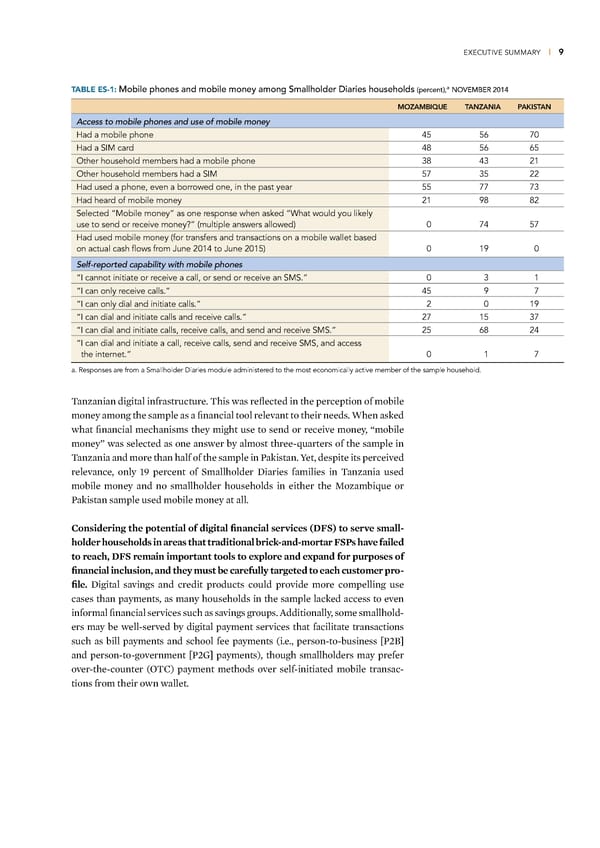

EXECUTIVE SUMMARY | 9 a TABLE ES-1: Mobile phones and mobile money among Smallholder Diaries households (percent), NOVEMBER 2014 MOZAMBIQUE TANZANIA PAKISTAN Access to mobile phones and use of mobile money Had a mobile phone 45 56 70 Had a SIM card 48 56 65 Other household members had a mobile phone 38 43 21 Other household members had a SIM 57 35 22 Had used a phone, even a borrowed one, in the past year 55 77 73 Had heard of mobile money 21 98 82 Selected “Mobile money” as one response when asked “What would you likely use to send or receive money?” (multiple answers allowed) 0 74 57 Had used mobile money (for transfers and transactions on a mobile wallet based on actual cash flows from June 2014 to June 2015) 0 19 0 Self-reported capability with mobile phones “I cannot initiate or receive a call, or send or receive an SMS.” 0 3 1 “I can only receive calls.” 45 9 7 “I can only dial and initiate calls.” 2 0 19 “I can dial and initiate calls and receive calls.” 27 15 37 “I can dial and initiate calls, receive calls, and send and receive SMS.” 25 68 24 “I can dial and initiate a call, receive calls, send and receive SMS, and access the internet.” 0 1 7 a. Responses are from a Smallholder Diaries module administered to the most economically active member of the sample household. Œan—anian digital infrastructure Œhis was reflected in the perception of mobile money among the sample as a financial tool relevant to their needs ™hen ased what financial mechanisms they might use to send or receive money, “mobile money” was selected as one answer by almost three-uarters of the sample in Œan—ania and more than half of the sample in aistan «et, despite its perceived relevance, only …ž percent of Smallholder ‰iaries families in Œan—ania used mobile money and no smallholder households in either the –o—ambiue or aistan sample used mobile money at all ”onsidering the potential of digital financial serices (DFS) to sere small- holder households in areas that traditional bricƒ-and-mortar FS‚s hae failed to reach, DFS remain important tools to e‡plore and e‡pand for purposes of financial inclusion, and they must be carefully targeted to each customer pro- file ‰igital savings and credit products could provide more compelling use cases than payments, as many households in the sample laced access to even informal financial services such as savings groups ˆdditionally, some smallhold- ers may be well-served by digital payment services that facilitate transactions such as bill payments and school fee payments (ie, person-to-business ¬‘£® and person-to-government ¬‘‡® payments), though smallholders may prefer over-the-counter (¦Œ†) payment methods over self-initiated mobile transac- tions from their own wallet

Financial Diaries with Smallholder Families Page 18 Page 20

Financial Diaries with Smallholder Families Page 18 Page 20