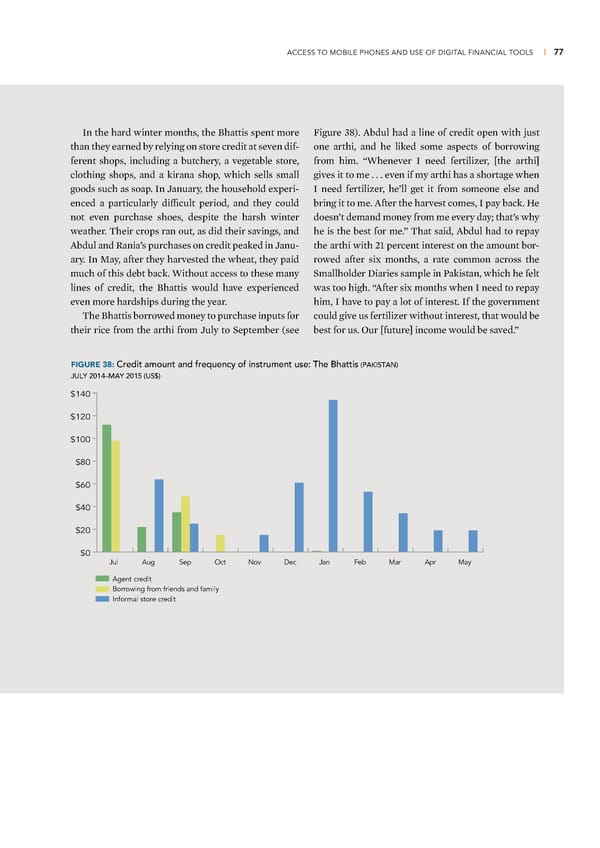

ACCESS TO MOBILE PHONES AND USE OF DIGITAL FINANCIAL TOOLS | 77 €n the hard winter months, the £hattis spent more igure Ÿ¡) ˆbdul had a line of credit open with „ust than they earned by relying on store credit at seven dif- one arthi, and he lied some aspects of borrowing ferent shops, including a butchery, a vegetable store, from him “™henever € need fertili—er, ¬the arthi® clothing shops, and a irana shop, which sells small gives it to me even if my arthi has a shortage when goods such as soap €n Žanuary, the household experi- € need fertili—er, he’ll get it from someone else and enced a particularly difficult period, and they could bring it to me ˆfter the harvest comes, € pay bac He not even purchase shoes, despite the harsh winter doesn’t demand money from me every day that’s why weather Œheir crops ran out, as did their savings, and he is the best for me” Œhat said, ˆbdul had to repay ˆbdul and ªania’s purchases on credit peaed in Žanu- the arthi with ‘… percent interest on the amount bor- ary €n –ay, after they harvested the wheat, they paid rowed after six months, a rate common across the much of this debt bac ™ithout access to these many Smallholder ‰iaries sample in aistan, which he felt lines of credit, the £hattis would have experienced was too high “ˆfter six months when € need to repay even more hardships during the year him, € have to pay a lot of interest €f the government Œhe £hattis borrowed money to purchase inputs for could give us fertili—er without interest, that would be their rice from the arthi from Žuly to September (see best for us ¦ur ¬future® income would be saved” FIGURE 38: Credit amount and frequency of instrument use: The Bhattis (PAKISTAN) JULY 2014–MAY 2015 (US$) $140 $120 $100 $80 $60 $40 $20 $0 JulAug SepOct Nov Dec Jan Feb Mar Apr May Agent credit Borrowing from friends and family Informal store credit

Financial Diaries with Smallholder Families Page 94 Page 96

Financial Diaries with Smallholder Families Page 94 Page 96