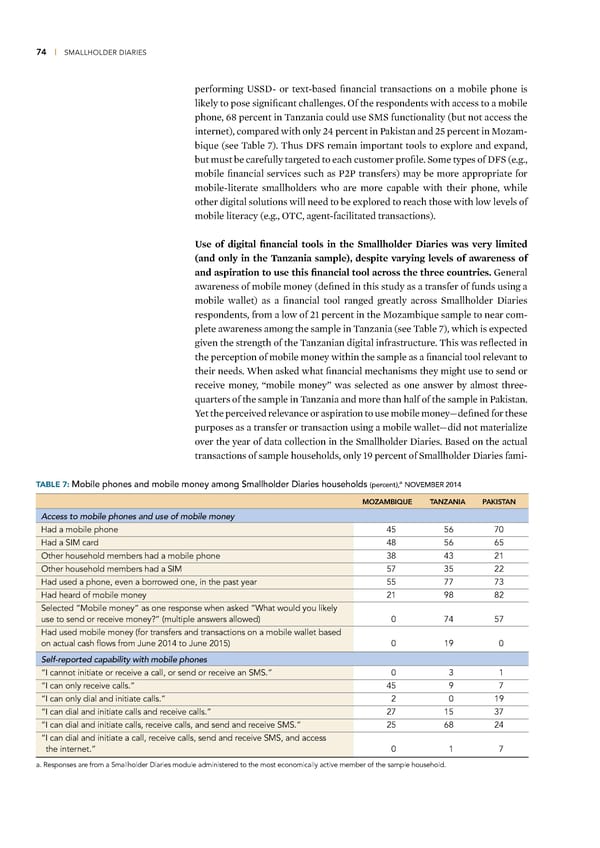

74 | SMALLHOLDER DIARIES performing ©SS‰- or text-based financial transactions on a mobile phone is liely to pose significant challenges ¦f the respondents with access to a mobile phone, ¢¡ percent in Œan—ania could use S–S functionality (but not access the internet), compared with only ‘“ percent in aistan and ‘” percent in –o—am- biue (see Œable •) Œhus ‰S remain important tools to explore and expand, but must be carefully targeted to each customer profile Some types of ‰S (eg, mobile financial services such as ‘ transfers) may be more appropriate for mobile-literate smallholders who are more capable with their phone, while other digital solutions will need to be explored to reach those with low levels of mobile literacy (eg, ¦Œ†, agent-facilitated transactions) “se of digital financial tools in the Smallholder Diaries was ery limited (and only in the anania sample), despite arying leels of awareness of and aspiration to use this financial tool across the three countries ‡eneral awareness of mobile money (defined in this study as a transfer of funds using a mobile wallet) as a financial tool ranged greatly across Smallholder ‰iaries respondents, from a low of ‘… percent in the –o—ambiue sample to near com- plete awareness among the sample in Œan—ania (see Œable •), which is expected given the strength of the Œan—anian digital infrastructure Œhis was reflected in the perception of mobile money within the sample as a financial tool relevant to their needs ™hen ased what financial mechanisms they might use to send or receive money, “mobile money” was selected as one answer by almost three- uarters of the sample in Œan—ania and more than half of the sample in aistan «et the perceived relevance or aspiration to use mobile money—defined for these purposes as a transfer or transaction using a mobile wallet—did not materiali—e over the year of data collection in the Smallholder ‰iaries £ased on the actual transactions of sample households, only …ž percent of Smallholder ‰iaries fami- a TABLE 7: Mobile phones and mobile money among Smallholder Diaries households (percent), NOVEMBER 2014 MOZAMBIQUE TANZANIA PAKISTAN Access to mobile phones and use of mobile money Had a mobile phone 45 56 70 Had a SIM card 48 56 65 Other household members had a mobile phone 38 43 21 Other household members had a SIM 57 35 22 Had used a phone, even a borrowed one, in the past year 55 77 73 Had heard of mobile money 21 98 82 Selected “Mobile money” as one response when asked “What would you likely use to send or receive money?” (multiple answers allowed) 0 74 57 Had used mobile money (for transfers and transactions on a mobile wallet based on actual cash flows from June 2014 to June 2015) 0 19 0 Self-reported capability with mobile phones “I cannot initiate or receive a call, or send or receive an SMS.” 0 3 1 “I can only receive calls.” 45 9 7 “I can only dial and initiate calls.” 2 0 19 “I can dial and initiate calls and receive calls.” 27 15 37 “I can dial and initiate calls, receive calls, and send and receive SMS.” 25 68 24 “I can dial and initiate a call, receive calls, send and receive SMS, and access the internet.” 0 1 7 a. Responses are from a Smallholder Diaries module administered to the most economically active member of the sample household.

Financial Diaries with Smallholder Families Page 91 Page 93

Financial Diaries with Smallholder Families Page 91 Page 93