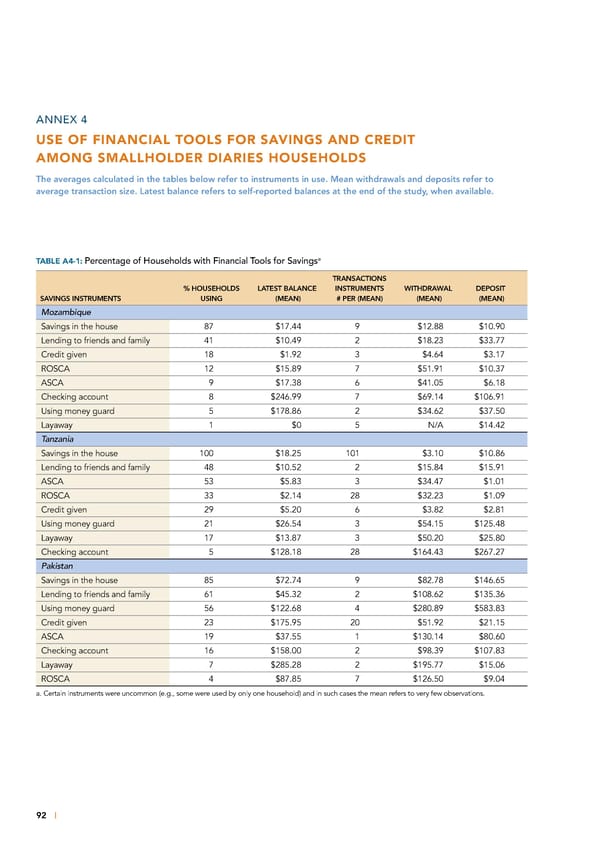

ANNEX 4 USE OF FINANCIAL TOOLS FOR SAVINGS AND CREDIT AMONG SMALLHOLDER DIARIES HOUSEHOLDS The averages calculated in the tables below refer to instruments in use. Mean withdrawals and deposits refer to average transaction size. Latest balance refers to self-reported balances at the end of the study, when available. TABLE A4-1: Percentage of Households with Financial Tools for Savingsa TRANSACTIONS % HOUSEHOLDS LATEST BALANCE INSTRUMENTS WITHDRAWAL DEPOSIT SAVINGS INSTRUMENTS USING (MEAN) # PER (MEAN) (MEAN) (MEAN) Mozambique Savings in the house 87 $17.44 9 $12.88 $10.90 Lending to friends and family 41 $10.49 2 $18.23 $33.77 Credit given 18 $1.92 3 $4.64 $3.17 ROSCA 12 $15.89 7 $51.91 $10.37 ASCA 9 $17.38 6 $41.05 $6.18 Checking account 8 $246.99 7 $69.14 $106.91 Using money guard 5 $178.86 2 $34.62 $37.50 Layaway 1 $0 5 N/A $14.42 Tanzania Savings in the house 100 $18.25 101 $3.10 $10.86 Lending to friends and family 48 $10.52 2 $15.84 $15.91 ASCA 53 $5.83 3 $34.47 $1.01 ROSCA 33 $2.14 28 $32.23 $1.09 Credit given 29 $5.20 6 $3.82 $2.81 Using money guard 21 $26.54 3 $54.15 $125.48 Layaway 17 $13.87 3 $50.20 $25.80 Checking account 5 $128.18 28 $164.43 $267.27 Pakistan Savings in the house 85 $72.74 9 $82.78 $146.65 Lending to friends and family 61 $45.32 2 $108.62 $135.36 Using money guard 56 $122.68 4 $280.89 $583.83 Credit given 23 $175.95 20 $51.92 $21.15 ASCA 19 $37.55 1 $130.14 $80.60 Checking account 16 $158.00 2 $98.39 $107.83 Layaway 7 $285.28 2 $195.77 $15.06 ROSCA 4 $87.85 7 $126.50 $9.04 a. Certain instruments were uncommon (e.g., some were used by only one household) and in such cases the mean refers to very few observations. 92 |

Financial Diaries with Smallholder Families Page 109 Page 111

Financial Diaries with Smallholder Families Page 109 Page 111